Credit Scoring

One button solution for innovative credit scoring. Fight bad loans with the AI-powered GiniMachine platform. Build unique scoring models and make solid credit decisions within seconds.

AI-driven Credit Scoring Solution

Learn moreAnalyze your data in a new automatic and autonomous way. GiniMachine can free you of manual work enabling to enjoy credit scoring. Empowered with AI and ML, the platform stands for accuracy in predictions and low-risk experience.

Machine Learning Credit Scoring

Discover how GiniMachine can level up your business. Get in touch with the team to explore the platform and enrich your credit scoring process.

Distinguish potentially bad borrowers to fend off undesirable risks. Tune your cut-off value and focus on application with high-performing figures. Using GiniMachine AI, you know how to properly manage your time.

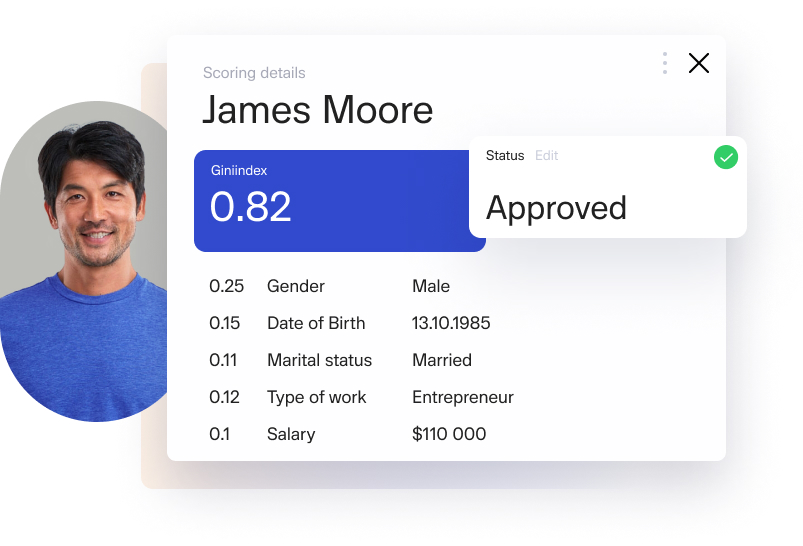

Assess potential customers in a more dynamic way with AI credit scoring. Analyze parameters that traditional systems ignore or miss out to reach thin-file borrowers. WIth GiniMachine, you will forget about limits and build hundreds of scoring models setting up unique parameters, such as age, occupation, location, etc.

Build business-oriented models by using cases from your historical data. Analyzing your previous credit-granting cases, GiniMachine will drive models that perfectly fit your business and your risk assessment rules.

Receive a detailed validation report every time a model is built. Our credit scoring solution allows tracking the discriminate power of models and getting valuable statistics, such as calculated Gini Index, K-S score, and others.

Enjoy the reduction in expenditures for solving standard credit scoring tasks. GiniMachine easily integrates into your routine working processes and saves your time. Besides, in case of any changes in your company, product offers, or target market, the system will easily adapt to anything.

Do not retrain your staff to integrate GiniMachine into your processes. Our credit scoring software doesn’t require experience in ML, coding, and statistics. Sign up, build models, score applications, and provide loans.

Discover how GiniMachine can level up your business. Get in touch with the team to explore the platform and enrich your credit scoring process.

Empower your decision-making process with a cutting-edge solution. Find out how our client already succeeded with GiniMachine AI and build your story with our team.

Case Studies

More case studiesGet a Live Demo

Empower your decision-making process with a cutting-edge solution. Find out how our client already succeeded with GiniMachine AI and build your story with our team.