AI Decision Making Platform

Your expertise is the key. We take the data and build models with high predictive power using artificial intelligence and machine learning. Together we find the right decision. We developed GiniMachine: data-driven decision-making software to watch and enjoy how talented experts and powerful AI fortify each other.

Automated Decision Making

Previously decision-making relied on spreadsheets and data visualization. But these tools can only show structured data from the past. AI decision-making algorithms help to lift the curtain over the future: simulate, compare, and fuel your business decisions. There is no need to have ML engineers or large teams of data scientists on board. GiniMachine automated decision-making platform can process terabytes of historical data. It builds, validates, and deploys risk models in minutes, not days.

Risk Management

Collection Scoring

Work with debtors and make collections straightforward with the help of AI. The solution helps to prioritize debtors with a higher chance for a fast payback. Decision-making software empowers collection by accurate predictions and saves the team’s efforts. It suggests using collection tools (calls, messages, or other) depending on the scoring parameters. As a result, collection businesses improve their productivity and avoid wasting time on non-performing debts.

Learn more

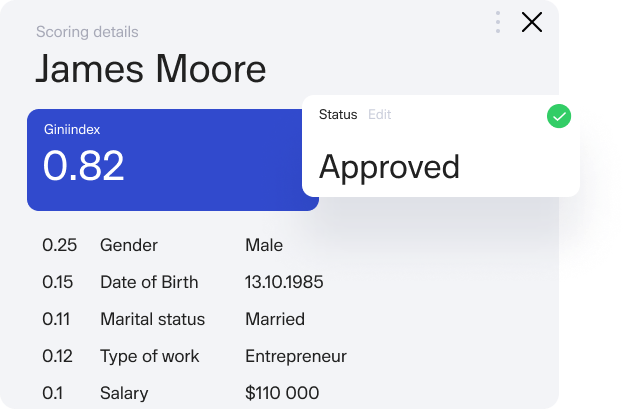

Application Scoring

The ability of the software to work with massive amounts of data can simplify the application scoring by identifying creditworthy borrowers in various industries. Using historical data of your business, GiniMachine can increase the returns in online loans, auto finance, POS lending, and more.

Learn more

Credit Scoring

Banks and fintech companies can leverage top-notch machine learning solutions to eliminate the drawbacks of traditional credit scoring. With the help of automated decision-making software, lenders can grant loans even to thin-file borrowers and find the optimum balance between the missed profit and commeasurable risks.

Learn more

Predictive Analytics

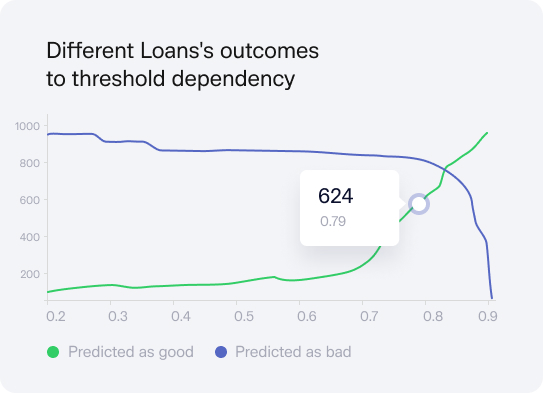

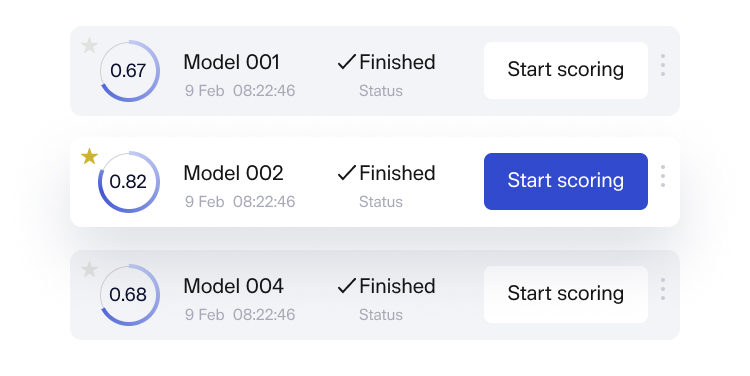

GiniMachine is a full-fledged decision-making platform for predictive analytics. It does a huge preparatory job and helps you make informed and balanced decisions. The system generates risk management models with high predictive power.

It takes at least 1000 records with maximum details and a binary status. The system works with raw data, so no preliminary preparation is required.

A detailed report comes with each new model. It helps track valuable insights and statistics, features and indices, as well as the model’s discriminatory power.

The resulting models are completely ready for credit scoring calculations and real-time predictions.

Banking

Digital transformation in banks requires new tools. GiniMachine works as decision making and credit scoring software for banks. There is just one button to help risk managers get a full picture without specific expertise in data science or machine learning. The readymade solution gives access to highly technological risk management and allows building models in a click.

Learn more

Financial Services

GiniMachine delivers reliable insights for financial services since 2016. High performing risk and credit scoring models benefit fintech businesses of any size. Artificial intelligence suggests, and you make the final decision and control the process to minimize risks, efforts, and time expenditures.

Learn more