Credit Risk Management

GiniMachine helps to build business-specific credit risk models automatically. Our credit risk management solution saves weeks of manual work and requires no special training and no extra skills.

AI Risk Management Software

Learn moreWe created a platform powered by AI and ML and aimed at making risk management in lending effective and hassle-free. GiniMachine builds, validates, and deploys credit risk models using your company’s historical data. It takes seconds or minutes to reveal hidden dependencies, compare and make informed business decisions.

Risk Management Software for Banks and Finance

The system provides full technical assistance to banks and financial institutions in decision-making. It helps to identify creditworthy borrowers across any type of lending, improve collection scoring, application scoring, and churn rate analysis.

Collection Scoring

Banks and financial institutions may lack risk management software that helps prioritize debtors with a higher payback probability. Empowered by AI, GiniMachine deals with scoring. It makes reliable predictions and analyzes collection tools to select the most effective ones for each case.

Learn more

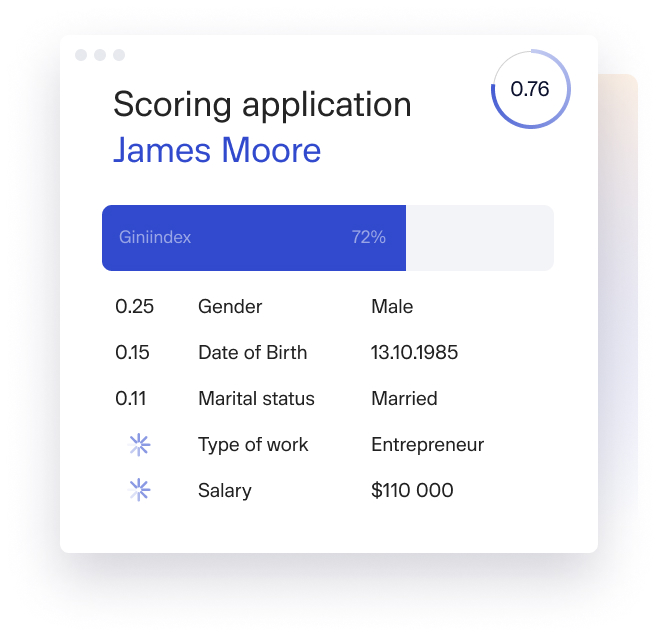

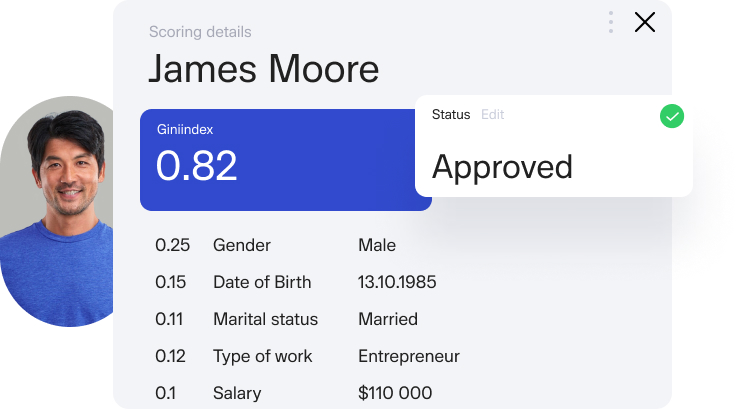

Application Scoring

Automated application scoring in banks and fintechs saves time, increases returns, and makes it possible to process thousands of applications within minutes. Suitable for big data analysis and any business domain

Learn more

Credit Scoring

Using an automated credit risk management solution for credit scoring, lenders can grant loans at low risk and reduce non-performing loans. The software fits online lending, commercial and POS lending, auto finance, credit card lending, and more.

Learn more

Spend a coffee break revealing new business opportunities powered by GiniMachine. Enter your email to receive an invitation from our team.

Competitive Edge of GiniMachine

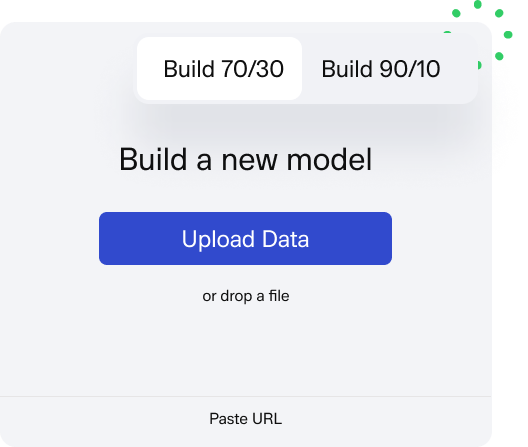

If we go backstage on GiniMachine, you can see a powerful web-based app with a machine learning core. We fortified the custom implementation of the tree ensemble method with handpicked heuristics and proprietary know-how. All that allows careful preliminary data processing, fast analysis, and user-friendly display of results.

- Works with any kind of data, both structured and unstructured. It builds, validates, and deploys models in 2-10 minutes.

- Provides proven economic efficiency — fewer NPLs, higher acceptance rate, better performance of a loan portfolio.

- Requires no special training, helps to save time and reduce labor costs. Upload your historical data and start using GiniMachine right away.

Case Studies

More case studiesGet a Live Demo

Meet the GiniMachine team, check out how it works, and discover the advantages for your business. Enter your contacts — and we will reach out to schedule a quick product tour.